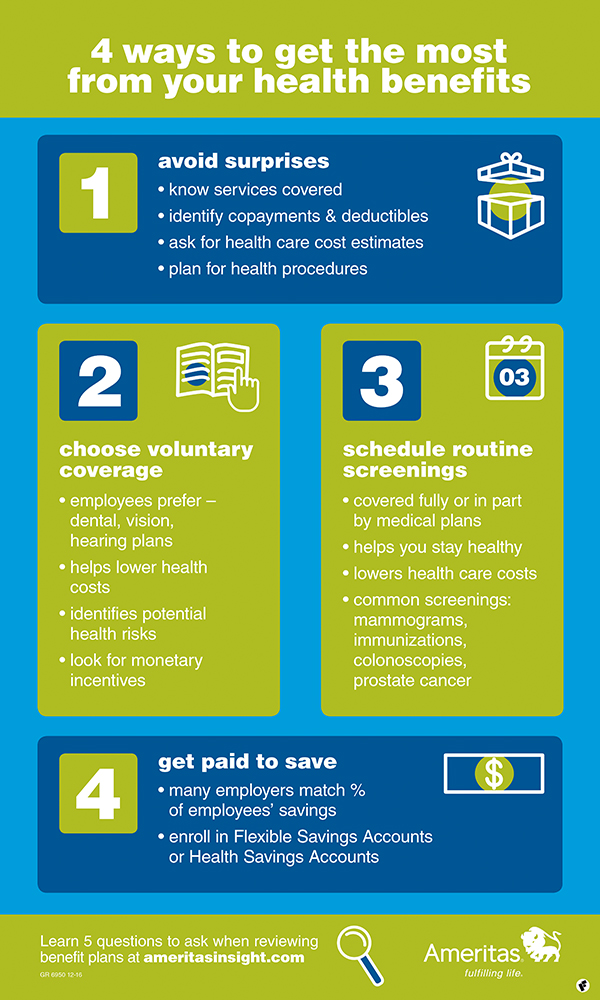

(Family Features) Often, employees enroll in medical insurance plans for protection against unpredictable events, sudden illness or serious health concerns that may result in expensive medical bills. Getting the most from your benefits requires understanding coverages and deductibles, as well as taking advantage of voluntary benefits, like dental, vision and hearing, to stay healthy and save money.

Avoid surprises. About 91 percent of adults in the United States are confused about what their benefits cover, according to a recent Harris poll. The best starting point is to review your plan so you understand the care and services covered. If you have a high-deductible plan, you will need to pay for most or a percentage of the health costs until reaching the individual or family deductible. Be prepared to pay any copayments or deductibles the plan requires before receiving care. Also, before scheduling appointments, ask for a cost estimate for the appointment, tests or service.

Preventive dental and vision. Many voluntary plans, such as dental and vision, offer preventive exams, such as routine cleanings and vision exams, that are fully covered. That’s because these preventive exams help to maintain and improve overall health and help reduce health costs. Voluntary coverage is affordable and many plans offer added incentives. For example, coverage for LASIK, dental, vision and hearing benefits can increase from one year to the next for those who continue to enroll and use their benefits. Members could earn monetary rewards to use for dental, vision, LASIK, orthodontia and hearing benefits, care materials and services simply by using their benefits and keeping the benefits paid out under a specified amount.

Medical screenings. Routine health screenings, such as mammograms, immunizations, colonoscopy procedures and prostate cancer screenings, which may be covered fully or in part by your medical coverage, can help you stay healthy and lower health care costs.

Get paid to save. Many employers encourage employees to save money by matching a percentage of the amount the employee contributes to the plan. If available, enroll in a Health Savings Account or Flexible Spending Account to set aside money to pay for health care costs.

Remember that these accounts are not a substitute for the coverage provided by voluntary benefits.

Learn more about the questions to ask when reviewing benefit plans at ameritasinsight.com.

Photo courtesy of Getty Images