(NAPSI)—With today’s technology, staying in touch with loved ones around the country—and the world—is easier than it’s ever been. We are connected to each other virtually day and night—from cell phones and video calls to social media, texting and e-mail. While we may rely on this technological closeness throughout the year, the holidays offer a unique opportunity to sit and spend time with family members, particularly older family members, whom we don’t see on a regular basis. This face-to-face time provides a chance to connect, catch up, and observe behaviors that may go undetected over the phone or through e-mail. Certain changes in these behaviors from year to year may indicate a need for long-term care.

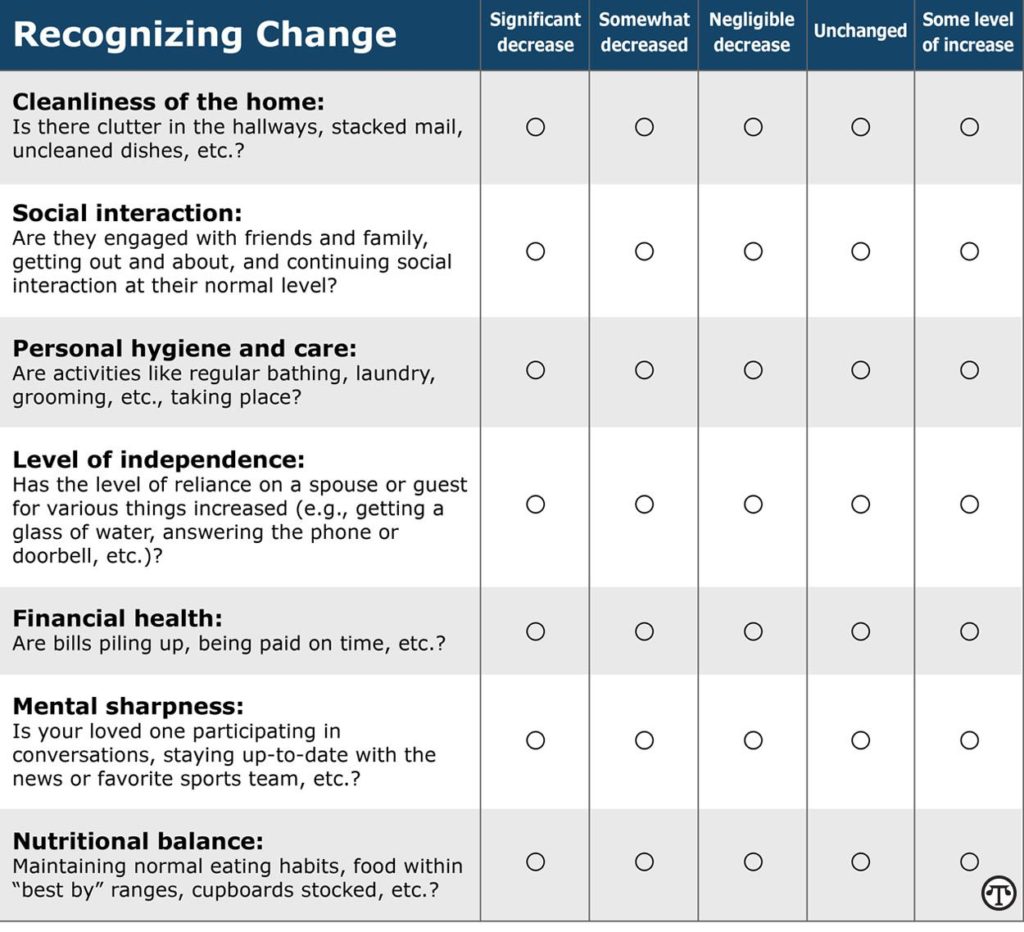

While each passing year will show some changes in an older family member’s capabilities and function, the table at right provides common changes in behavior to watch for to get a better idea of where your loved ones stand functionally. It’s important not to focus on the behavior itself, but rather the change in that behavior compared to what is considered normal for that person. For example, someone who has always been quiet and somewhat introverted would be held to a different standard than someone who is usually very outgoing and conversational, but now seems withdrawn and isolated. Based on the information you gather, it may be time to start thinking about your family’s plan for long-term care.

The time to plan is now

Millions of Americans require long-term care at some point during their lifetime.* This type of care includes assistance with everyday activities like bathing, dressing and eating, or supervision due to a severe cognitive impairment like Alzheimer’s disease. Surprisingly, the type of care needed to provide assistance with these activities can be expensive and is generally not covered by traditional health plans or Medicare. In many cases, taking care of an older relative often falls on family members or friends. However, depending on the location of family members and friends, this support is often not available or may be a bigger challenge than many expect or are willing to take on.

Take a closer look

By paying attention to some common behaviors, you can begin to determine whether a loved one is having difficulty performing everyday activities. Noticing changes in behavior that may be due to an emerging physical or cognitive impairment is an important first step.

Based on what you observe, the Federal Long Term Care Insurance Program (FLTCIP) may be worth considering when developing your family’s plan for long-term care.

How did you answer?

Mostly unchanged. The best time for you and your family members to consider long-term care insurance is long before it’s needed. Because the FLTCIP is medically underwritten, it’s important to apply while you’re still in good health to avoid the risk that a future illness or medical condition may prevent you from obtaining coverage later. Also, premiums are directly related to age. This means that premiums tend to be lower for younger applicants.

Recognized changes. If you’re already a FLTCIP enrollee and recognize some of these behavioral changes in a loved one, contact a FLTCIP care coordinator at the phone number provided at right to gather important information about the different care options that may be available. A call to one of their licensed health care practitioners can provide valuable information such as an assessment of need, direction on developing a plan for long-term care services, and access to discounted services and providers, where available. The FLTCIP, unlike most long-term care insurance plans, provides certain care coordination services to qualified relatives of enrollees at no cost.

FLTCIP eligibility

Many members of the federal family are eligible to apply for coverage under the FLTCIP, including federal and U.S. Postal Service employees and annuitants, as well as active and retired members of the uniformed services. Qualified relatives such as spouses, domestic partners, parents and parents-in-law, and adult children are also eligible to apply. For a complete eligibility list, visit www.LTCFEDS.com/eligibility.

To learn more about the FLTCIP, visit www.LTCFEDS.com. For personalized assistance, call (800) LTC-FEDS (800) 582-3337)/ TTY (800) 843-3557 to speak with a program consultant. Consultants are available to answer any questions you may have and can walk you step by step through the plan design and application process.

* Centers for Disease Control and Prevention. “Long-Term Care Services in the United States,” www.cdc.gov/nchs/data/nsltcp/long_term_care_services_2013.pdf (accessed March 2015).

FLTCIP6451

On the Net:North American Precis Syndicate, Inc.(NAPSI)